Making Your Moves More Important to Railroads

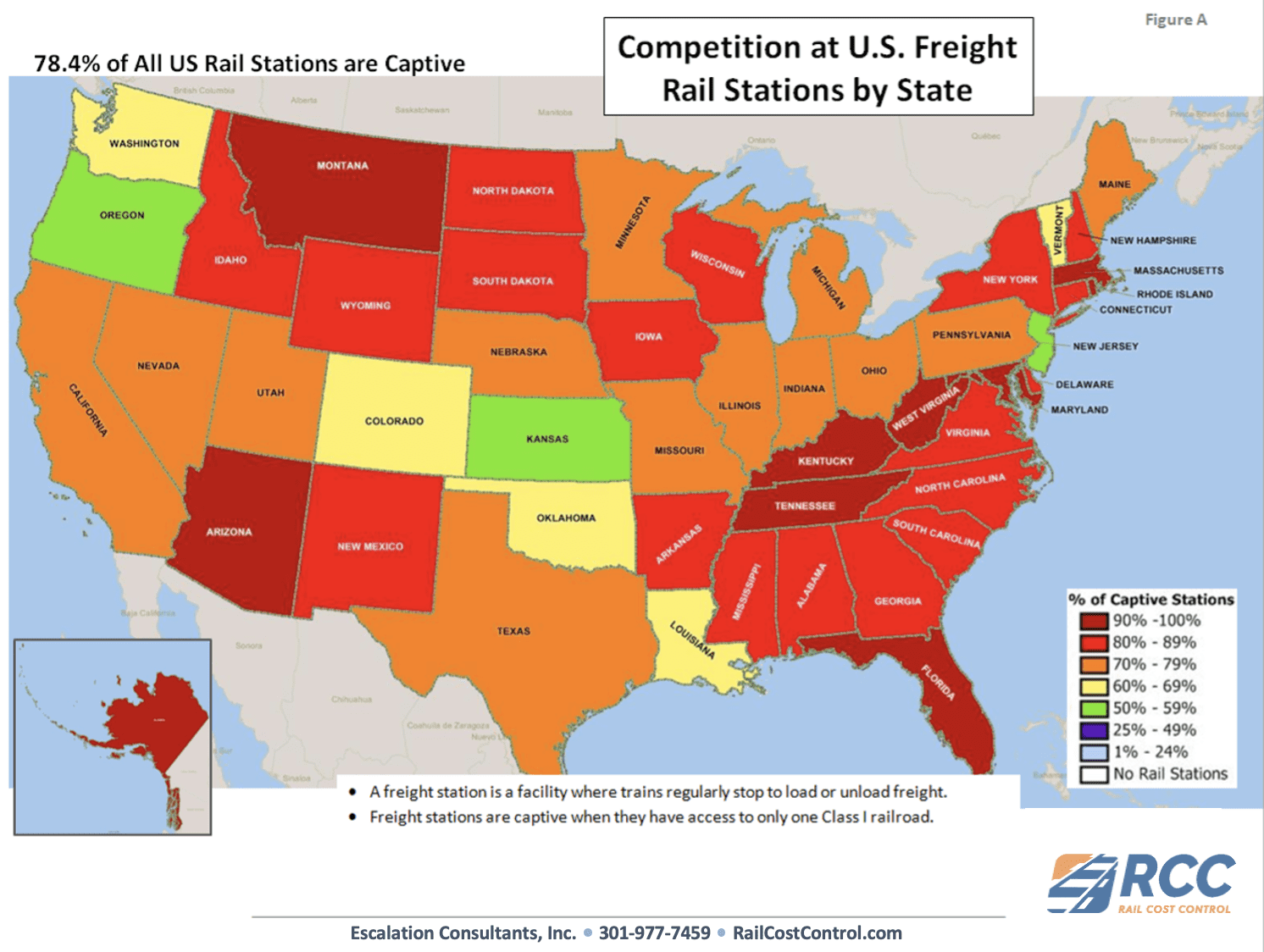

The Rail Station Captivity Map

A basic rule to follow in getting more attention to your issues from railroads:

If you have the ear of people that are important to your railroads, then you make your moves more important to railroads.

Politicians have a big influence on railroads and can have a very positive impact on shipper’s rail negotiations. Politicians are also easy to access as they want to talk to shippers for self-serving reasons. Obtaining political support for your position in rail negotiations costs very little to pursue and can yield a positive return. The Rail Station Captivity Map was developed by Escalation Consultants to support discussions with politicians on railroad issues.

The Rail Station Captivity Map shows that 78.4% of all rail stations in the United States are captive to one Class I Railroad.

Figure A is color coded to show the percentage of all rail stations by state, that are captive to a single Class I railroad. Rail stations are captive if they don’t have either direct or indirect access, through a short line, to more than one Class I Railroad.

The number of states in each captivity range are shown below.

Breakdown of Rail Station Captivity in the US |

|

# of States |

% of Stations Captive to One Major Railroad |

| 10 | 90% – 100% |

| 18 | 80% – 89% |

| 13 | 70% – 79% |

| 5 | 60% – 69% |

| 3 | 50% – 59% |

| 0 | 25% – 49% |

| 0 | 1% – 24% |

| Note: Hawaii is not included. | |

Railroads are always concerned about politicians, as they can have a significant impact on how railroads are allowed to operate. Unfortunately for railroad customers, it is frequently difficult to get the attention of politicians on rail rate issues. This is because the problems shippers experience with railroads are complex and not easy to explain.

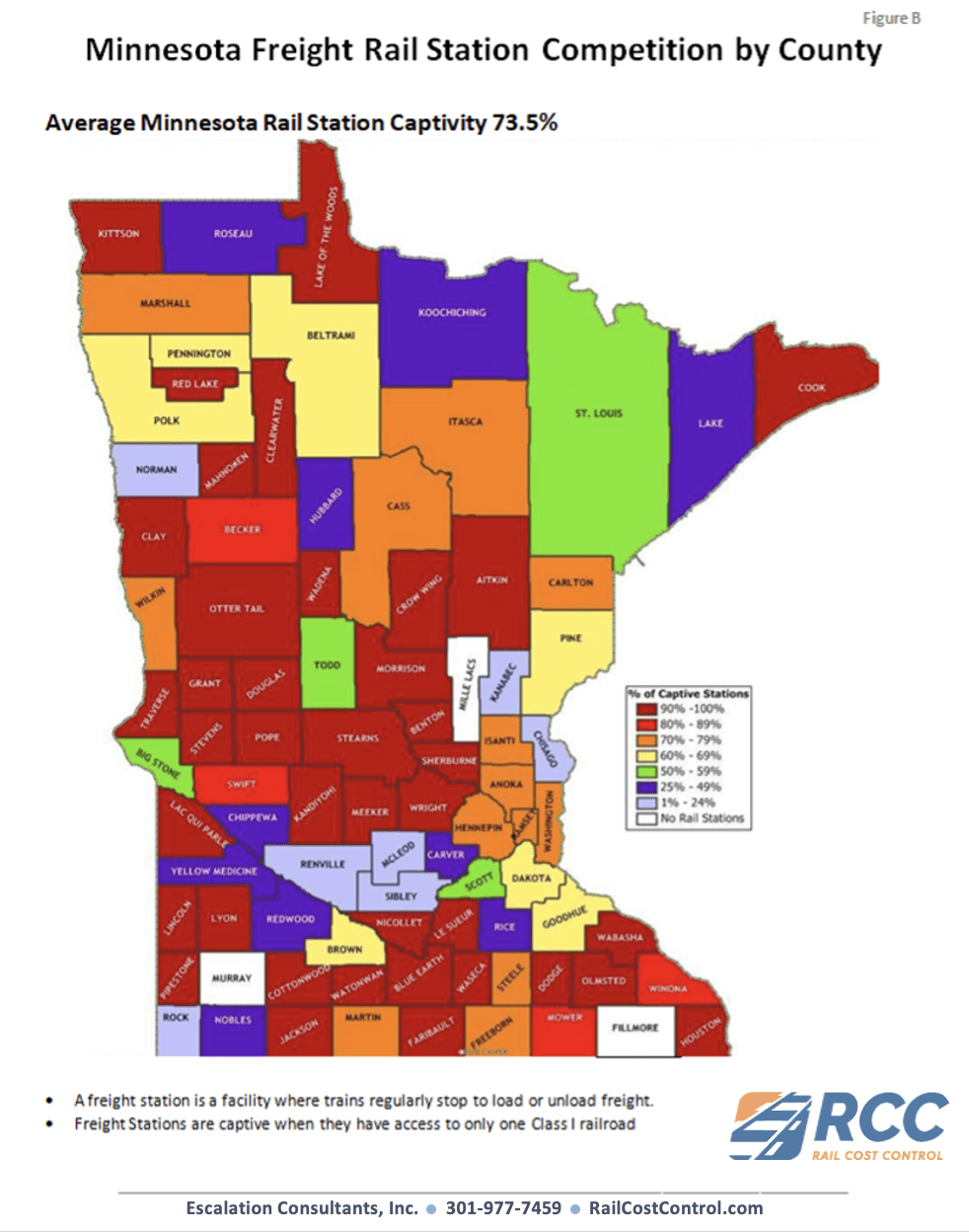

It is easier to get a politician’s attention with an easy-to-understand picture, highlighting the importance of rail to specific areas they represent. Figure B shows this as it contains the rail station captivity by County for the state of Minnesota. Rail Station Captivity Maps are available, by county and Congressional District, for all states in the United States.

Escalation Consultants is making state maps available for rail shippers. Simply contact Escalation Consultants to request the Rail Station Captivity Map for your states of interest.

The State Rail Station Captivity Maps are effective at getting the attention you need to help resolve problems. When shippers want to make movements more important to railroads, getting the attention of Congressmen and Senators is a good way of accomplishing this. Please note: all politicians do not have the same amount of sway over railroads. In addition, there is a right way and a wrong way to deal with politicians. This needs to be understood, and allowed for, in your discussions with politicians.

Rail Station Captivity Maps, for a specific area, are an excellent way of showing railroads and politicians why production will not increase, and capital investment will not be made at an existing location that is captive to one Class I railroad. Captivity maps illustrate areas that will have difficulty in achieving economic development from companies that rely on rail freight.

Shippers need to be able to show that railroads’ monopoly power over captive movements at a facility creates problems for both politicians and railroads.

Rail Station Captivity Maps are proof of the expression: “A picture is worth a thousand words.” Shippers are encouraged to use these maps to increase their leverage in rail negotiations.

Rail Cost Control (“RCC”) is a program developed by Escalation Consultants, Inc. to help shippers reduce rail expenses by managing costs and empowering negotiations. For more information about RCC and other related articles, visit the RCC Blog.”