Updates to STB’s Carload Waybill Sample

Big improvements Coming to the STB’s Carload Waybill Sample

The best source for understanding railroad rates and volumes for commodities into specific markets is the STB’s Public Use Waybill Sample (Waybill). The Waybill contains information that can significantly impact a shipper’s rail negotiations. It can also positively impact decisions made in shipper’s marketing and sales departments. Improvements made to Waybill data are, therefore, important for shippers to understand.

There are two big improvements in the Waybill data for merchandise traffic that shippers must be aware of. The first improvement will go into effect later in 2021 or early 2022. The second improvement is still being studied by the STB.

Waybill Improvement 1

The upcoming 2020 Waybill will contain more rates, volumes, origins, and destinations for merchandise traffic rail movements. This means merchandise traffic will contain:

- Increased number of origin and destination market areas.

- More accurate estimates of specific commodity volumes going into markets.

- More accurate estimates of where volumes into markets originate.

- Improved information on rates shippers compete against in markets.

This increase in merchandise traffic data will be offset by decreasing the number of intermodal movements the Waybill contains. This change is being implemented because the Waybill is primarily used by merchandise traffic shippers. These improvements will go into effect with the release of 2020 Waybill data. The 2020 Waybill data is expected to be released in late 2021, or early 2022.

Waybill Improvement 2

If this improvement is implemented, the Waybill will be released Quarterly, not Annually. This improvement is still being studied by the STB. However, if this change is enacted, Waybill data will become much more current.

In the existing system, Waybill data is at least one year old. Much of the data is closer to two years old before the STB releases an updated Waybill. For example, if the Waybill data for year 2020 is released in December 2021, there will be a one-year lag in data for the fourth quarter of 2020. However, there will be close to a two-year lag for data from the first quarter of 2020. The new quarterly Waybill system would only have a two-to-four-month delay in rate and volume information for all Waybill data.

Waybill Improvement 2 is important because the more current Waybill data is, the more useful Waybill data becomes!

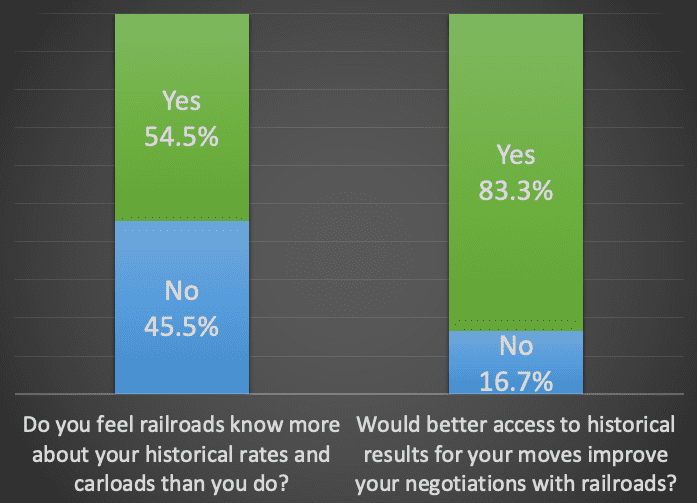

Importance of Waybill Data

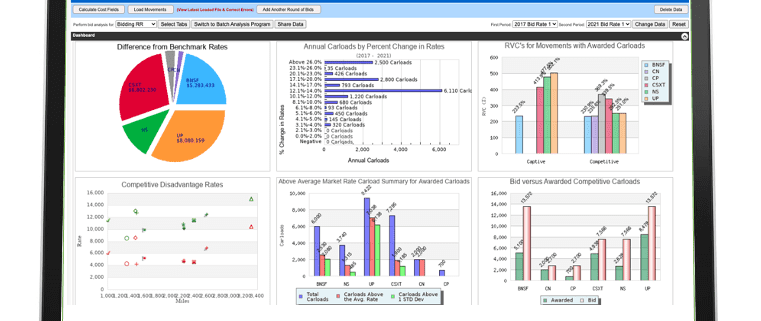

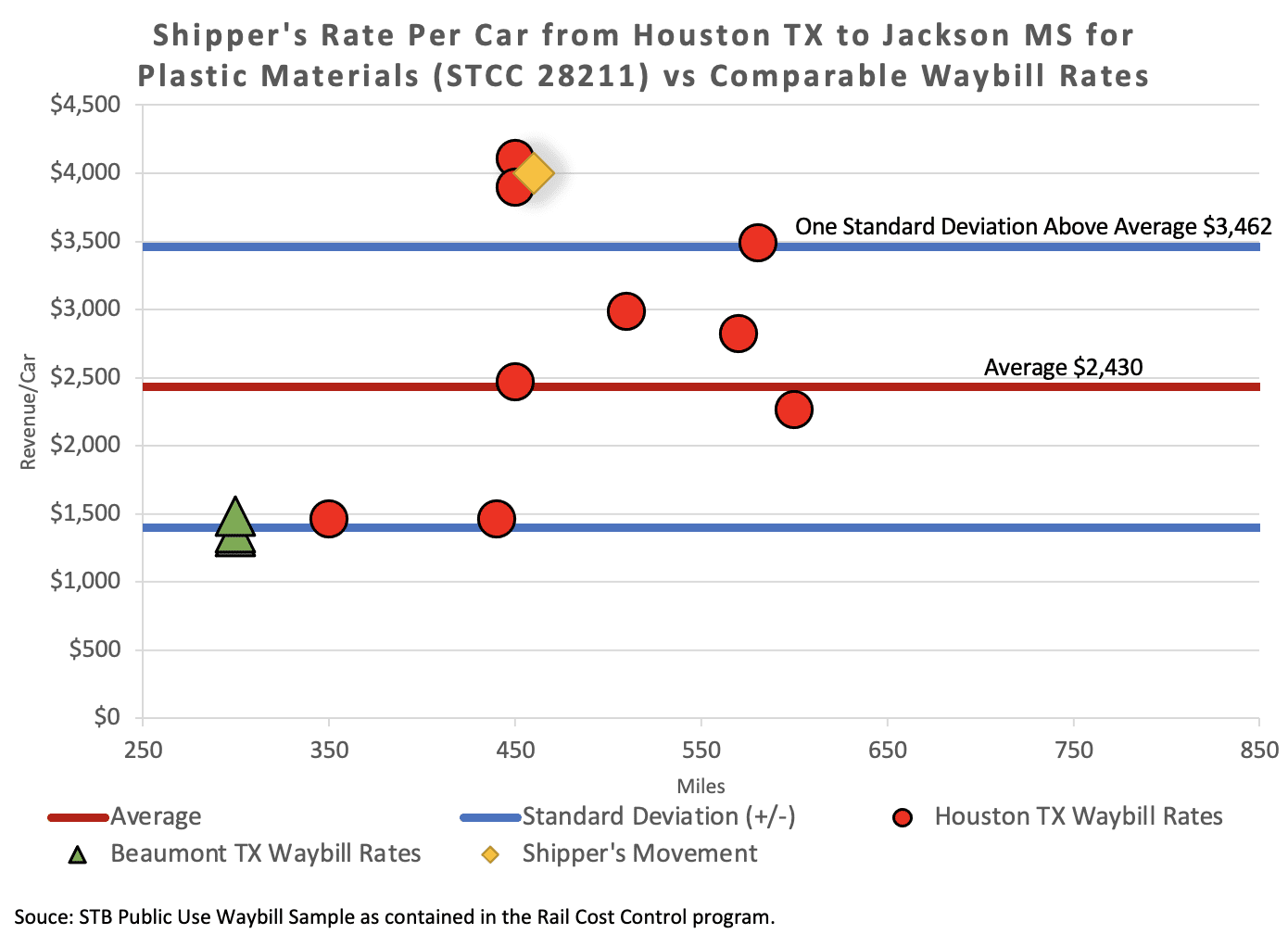

The importance of the Waybill data in determining reasonable rates for rail movements is shown in the following scatter graph:

The scatter graph is automatically generated through the Rail Rate Checker Section of the Rail Cost Control Program

The graph shows the following data:

- Shipper’s rate of $4,000 for a 450-mile Plastic (STCC 28211) movements from Houston, TX to Jackson, MS (yellow diamond)

- Waybill rates for Plastic moves to Jackson, MS from both Houston, TX (red circles) and Beaumont, TX (green triangle)

- A $2,430 Average Waybill rate into Jackson, MS (refer to the red line)

- $3,462 is the rate that is One Standard Deviation above the average Waybill rate (refer to the top blue line)

The graph shows the value shippers get from access to Waybill data. The illustration provides a clear picture of the problems with the $4,000 rate for the shipper’s Plastic movements. The graph shows:

- The $4,000 rate is more than One Standard Deviation above the Average rate into Jackson, MS

- Houston rates are $1,000 to $2,5000 higher than rates out of Beaumont, TX

- The $4,000 rate puts the shipper at a competitive disadvantage in the Jackson, MS market

- It is difficult for the shipper to compete in this market with a $4,000 rail rate

The Waybill is already a very valuable tool for rail shippers. The STB’s proposed improvements to timeliness and number of moves, will increase the value of the Waybill for rail shippers.

Escalation Consultants, Inc. developed Rail Cost Control (“RCC”) to help shippers reduce rail expenses by managing costs and empowering negotiations. Furthermore, for more information about RCC and other related articles, visit the RCC Blog.