Optimizing to Reduce Shippers Rail Expenses

The most productive rail negotiations are win/win negotiations where a shipper gets lower rates and the railroad makes greater profit. These type of win/win negotiations are easier to develop than many shippers realize. The best way to create this type of win/win outcome is by a shipper optimizing railroads rates when performing the bid evaluation.

Millions of dollars in value are created for shippers and railroads through the optimizing process:

-

-

-

- The benefit to shippers is cost reductions of 5% to 15%; while,

- Railroads benefit from a substantial increase in revenue and profits.

-

-

This optimizing process starts by a shipper calculating the railroad’s long term Variable Cost (Cost). This Cost is calculated for ALL rates in a railroad’s bid. Shippers frequently calculate the railroad’s cost for a movement to show that a railroad is making too much profit from the movement. Unfortunately, this is frequently not very effective.

A more productive use of railroad costs is to better understand how a shipper can increase or decrease railroad’s profits with volumes it can add or takeaway in negotiations.

Calculating railroad’s cost for all of a shipper’s moves, opens opportunities to create greater value for both shippers and railroads. It is best for a shipper to use a macro processing program like the Rail Cost Control Program (RCC) to calculate the cost of all rail moves at one time. Calculations are effortless, as rail costs are automatically calculated and maintained for use in RCC’s bid evaluation optimizing program.

Once a shipper knows the railroad’s costs for moves, it has a much better understanding of the economic impact of adding, or taking away, moves from railroads in the bid evaluation. When a railroad’s rates are reduced it becomes the low bidder on more competitive traffic in the bid evaluation. As a railroad wins more competitive traffic, its carloads increase as well as the profit it makes from the shipper’s business.

It is important to find win/win opportunities with your railroads. These opportunities come from understanding the relationship between reductions in spend a shipper receives from reduced rates versus the increase in profit the railroad receives from obtaining additional volumes.

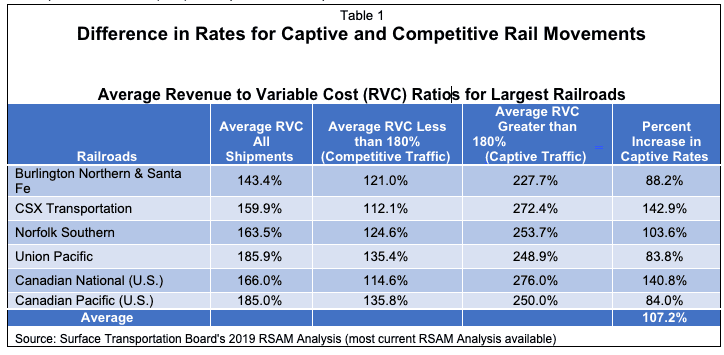

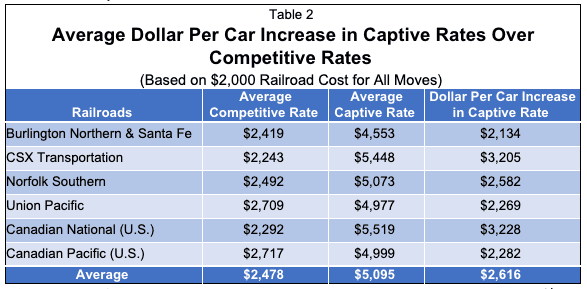

As an example, if competitive rates are reduced by 11% on a railroad resulting in $6 million in savings this looks like a great deal for the shipper. But is this a good deal for the railroad? The shipper needs to know the economic impact on the railroad. If the railroad is awarded an additional 3,100 carloads, because it is now the low bidder on more competitive carloads, the shipper needs to know how this impacts railroad profit. Table 1 provides a summary of the results for the 11% rate decrease.

Table 1

Example of Summary Results for a 11% Rate Reduction on a Railroads Competitive Moves |

|

Shipper Savings |

$6.0 million |

Increase in Railroad Profit |

$7.3 million |

Increase in Railroad Revenue |

$13.4 million |

Increase in Railroad Carloads |

3,100 |

Table 1 shows that the 3,100 additional carloads represent a $7.3 million increase in the railroad’s profit. This is $7.3 million in profit and $13.4 million in revenue the railroad would not get with the rates in its original bid. Table 1 shows that the railroad makes out better than the shipper from the 11% rate decrease. The value to the railroad is $1.3 million greater ($7.3 million versus $6.0 million) than the value to the shipper. By optimizing, you then equalize the benefits from strategic decisions on rates and volumes.

Optimizing created $6 to $7 million in value for both the shipper and the railroad.

Though the value created by the 11% rate decrease is significant, it may not be the best rate decrease for either the shipper or the railroad. The question that needs to be answered, is how do you know the rate decrease that creates the most value for the shipper and railroad? Would a larger 15% rate decrease generate greater value or would a lower 7% rate decrease work best. Answering this question, you’ll need to know the optimizing Pivot Point for rates in each railroad’s bids for competitive traffic.

Understanding each railroads Pivot Point is important as it:

- Generates greater value from the optimizing process; and,

- Brings captive rail movements rates into the optimizing process.

Understanding the Pivot Point increases the value created from optimizing. As an example, the Pivot Point for the rail traffic used in this article increases the value created by optimizing by an additional 71% (more than a $5 million increase) . This is not an unusual Pivot Point optimizing result for mid to large rail shippers. Optimizing the rates in railroads bids creates a significant increase in value for the shipper and the railroad.

It should be noted that though the calculations for optimizing are complex the process has become very easy to perform. For example, the Pivot Point is automatically calculated for the rates in each railroad’s bids in RCC’s: Cost Optimizer.

Our next blog will address determining the Pivot Point for each railroad and bringing captive rates into the optimizing process.

Escalation Consultants, Inc. developed Rail Cost Control (“RCC”) to help shippers reduce rail expenses by managing costs and empowering negotiations. Furthermore, for more information about RCC and other related articles, visit the RCC Blog.