The Big Issue with Rail Contract Escalation

The index most commonly used to escalate rates in rail contracts is the All-Inclusive Index Less Fuel (AII-LF) so the changes in this index have a big impact on the rates most shippers pay for moving rail freight. As a result, the dramatic upward and downward changes that have occurred in the AII-LF index over the last 5 quarters are a big concern to many rail shippers.

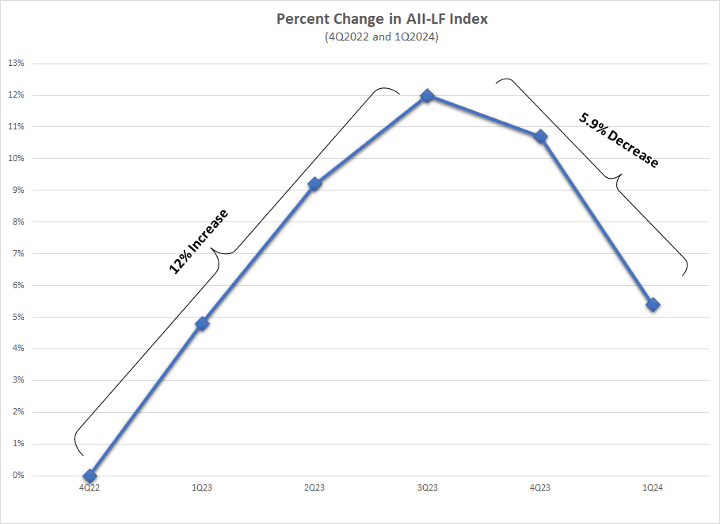

Illustration 1 shows that the AII-LF index:

-

Increased 12% Over the first 3 quarters of 2023, and then

-

Decreased 5.9% over the next two quarters (Q4 2023 and Q1 2024).

(Illustration 1)

To understand the rate of change to expect from an index it is important to understand what is included in the content of an index and what is driving changes in components of an index. By way of background the AII-LF index is assembled by the Association of American Railroads (AAR), but half of the cost changes that go into the index are tied into changes in BLS Producer Price indexes. However, the most volatile component of the AII-LF index is the Labor component which is assembled by the AAR and currently has a weight of 37% in calculating the overall change in the AII-LF index.

Labor is by far the largest component of the AII-LF index and it is also the major component developed from internal railroad costs. The big swings in the AII-LF index between Q4 2022 and Q1 2024 are directly related to big changes in the values of the Labor component.

These changes were driven by:

-

The railroads new union wage agreement signed in December 2022, as well as

-

The 3-year delay in finalizing a new wage agreement with the unions.

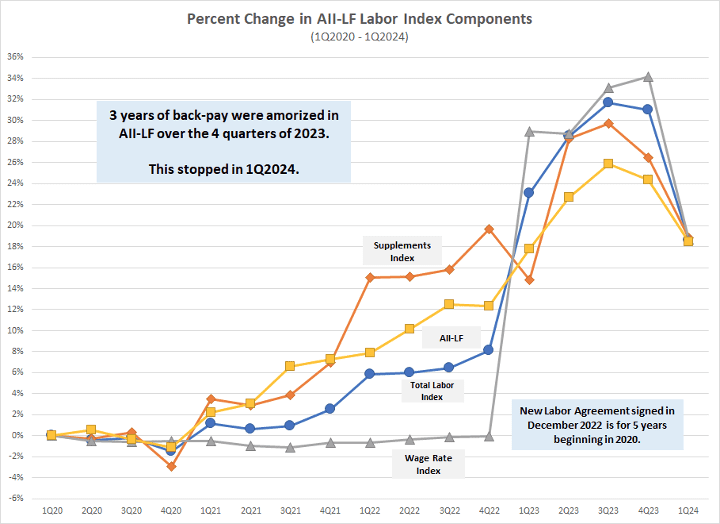

To show the impact that the Labor index has had on the AII-LF index, Illustration 2 tracks percent changes from Q1 of 2020 through Q1 2024. The illustration includes the percent change in the Labor Index along with its subcomponents of Wages and Wage Supplements, as well as the change in the AII-LF index.

(Illustration 2)

Illustration 2 shows that wages did not change over the 3-years between Q1 2020 and Q4 2022. This is because the old union agreement ended at the end of 2019, but a new agreement was not signed until December of 2022. The Labor index increased over this 3-year period because Wage Supplements increased 20%. However, wages did not change because there was no new agreement with the unions. The overall Labor index increased 8% which was well below the 12% increase in the AII-LF index.

The new Labor Agreement, signed in December 2022 results in the Wage index increasing 29% in one quarter. The large wage increase in Q1 2023 occurred for multiple reasons:

-

Current Wage Increases

-

Current $1,000 service recognition bonus

-

Back pay for prior 3 years of wage increases

-

Back pay for 3 years of annual $1,000 service recognition bonuses.

There was an immediate lump sum payout of approximately $16,000 per employee for retroactive back pay and annual service recognition bonuses. This $16,000 amount was amortized into the Wage index over the four quarters of 2023. This was a major contributor to the 29% increase in the Wage index between Q4 2022 and Q1 2023. Illustration 2 shows that in 2023 the large increase in wages had a big impact on Wage Supplements, the Labor index and the AII-LF index.

In 2024 most of the amortization of wage costs resulting from the 3-year delay in finalizing a new Wage Agreement went away. For example, back pay amortization in the Wage index went from $7 per hour in Q4 2023 to $0 per hour in Q1 2024. This is the major reason for the big decreases in Q1 2024 in the:

-

Wage Index

-

Wage Supplements Index

-

Labor Index

-

AII-LF Index

There is an important takeaway from what has happened to the AII-LF index over the last five-quarters. This is that shippers need to do their homework before using this index to escalate rail rates in contracts. Determining whether to escalate contracts by a set rate of annual increase or use the AII-LF index, you need to understand:

-

The composition of the index

-

Changes that can be foreseen which will positively or negatively impact the rate of change in the AII-LF index

Rail shippers must prioritize this task as the current Union Wage Agreement expires at the end of 2024. In case of anticipated negotiation delays between unions and railroads, using the AII-LF index for short-term agreements can be advantageous as wage rates won’t increase immediately. However, shippers should expect significant increases in the AII-LF index when there are delays in reaching agreements between unions and railroads.