Benchmark to Reduce Rail Expenses

To reduce rail expenses and consistently improve performance, companies need to consistently benchmark. The reason for benchmarking is simple. If you do not benchmark, you will likely do things the same way next year as you did this year. This means the problems you have this year will not get corrected.

When negotiating with railroads that have monopoly power over your traffic it needs to be recognized that:

You will always tend to receive rate increases

IF

You do not know what reasonable rates are for your movements.

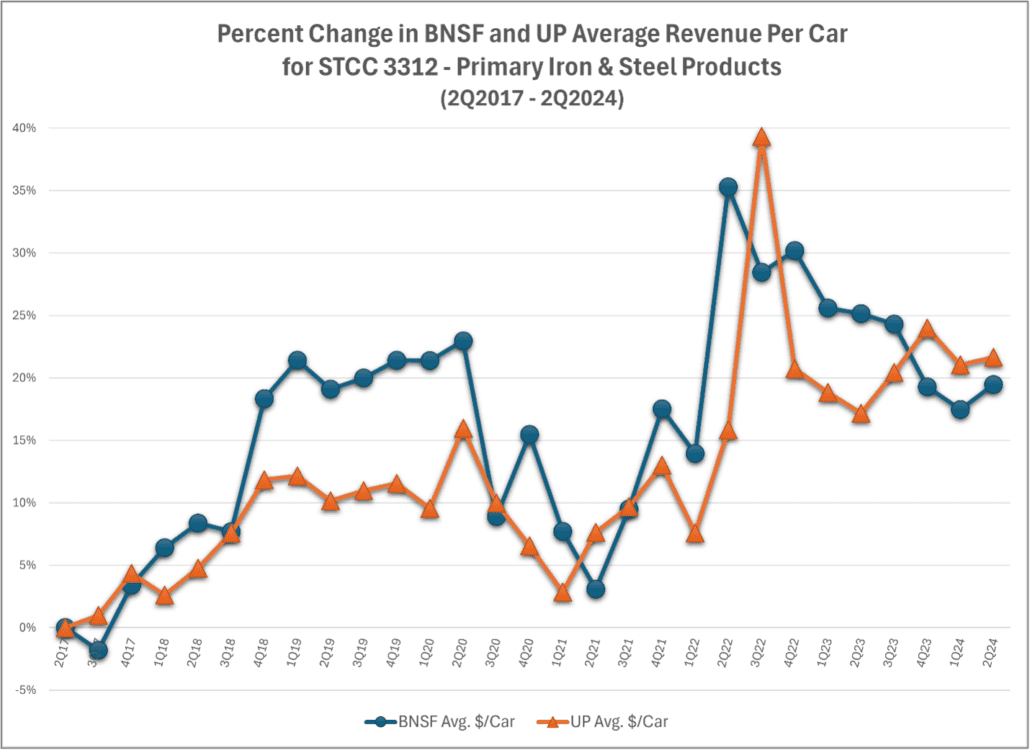

A comparison of railroad’s historical rate changes indicates that railroads are very active with rate benchmarking. The graph below provides an example of the results from railroad benchmarking. It shows the percentage change in average rate per car for all Primary Iron & Steel Products (STCC 3312) BNSF movements, versus UP.

Source of data: Railroad’s Freight Commodity Statistics as contained in Rail Cost Control

The illustration shows that over the last seven years the percentage change in the average rate per car for all Primary Iron and Steel product moves on BNSF are similar to those of UP. The percentage change in the average rate per car for BNSF and UP frequently separate, but they normally tend to come back to the same type of rate change. The overall average rate change is similar for both railroads during most periods with the railroads exchanging places as to who has the highest rate increases from time to time.

Rail shippers should learn from the practices of railroads and use the data available to them to benchmark their rates against the rates of their competitors.

This is valuable information that will show whether a shipper is being put at a competitive disadvantage in its markets. This market intelligence helps shippers improve their competitive position in markets.

Benchmarking is just common sense. It is always important to find out how well you are doing in the market compared to other companies. To demonstrate, the chart below tracks Grain Mill Products (STCC 204) rates, for movements into the Dallas TX market from major origin locations. Rates are organized on the vertical axis and distance shipped on the horizontal axis.

Source of data: Public Use Waybill as contained in Rail Cost Control

The first thing to notice in this illustration is, that the miles for a movement do not necessarily determine the level of the rate for a movement.

For example, movements from Wichita, KS go the shortest distance to Dallas, TX (370 miles) and movements from Des Moines, IA go the longest distance to Dallas, TX (950 miles). However, many of the rates for both of these origins are similar even though Des Moines, IA moves go almost three times the distance. A similar relationship happens with moves from Kansas City, MO. Many of the rates from Kansas City, MO are similar to rates from Des Moines, IA even though Kansas City, MO moves go half the distance to Dallas, TX. This shows that just because you have a geographic advantage in a market does not mean you have a competitive advantage in a market. This is important information for shippers’ marketing and sales departments to know.

When looking at this graph, assume you are a supplier located in Davenport, IA with shipments that travel 950 miles at a rate of $6,701 per car, which is the average rate for all shippers from Davenport, IA into Dallas, TX. Some may say this shipper is getting the average rate from Davenport, IA and has nothing to complain about. But, from the Davenport Shipper’s point of view:

- Many competitors ship into Dallas, TX with considerably lower rates;

- Most shippers from Des Moines, IA have significantly lower rates, while shipping a similar distance; and,

- The average rate into the Dallas, TX market for all movements is $4,589 which is $2,112 less than the average rate from Davenport to Dallas.

If you are a Davenport, IA shipper with a $6,701 rate you would have important issues to discuss with your railroad as you are being put at a competitive disadvantage to shippers from other market areas.

If you are an Omaha NE shipper with a $6,000 rate into Dallas, then the $3000 and $4000 rates of other Omaha shippers are important to discuss with railroads as they are likely hurting your business. Rate benchmarking yields significant savings as it increases your negotiation leverage to obtain better rates for your rail traffic.

Once you know how your rates stack up against competitors in a market, you have a different negotiation with railroads. Your preparation for negotiations will also be different, especially in your important high-volume markets. There are several questions the benchmarking exercise raises:

-

Are there opportunities to reduce transportation costs through a forward storage site, or transload?

-

Can a commodity swap or buy/sell agreement with another supplier be negotiated to reduce freight expenses for both companies? (Note- these agreements tend to be short term until a railroad gets the message that you have options)

-

Can your competitive carloads be bundled with captive carloads in negotiations to obtain better rates from railroads on your captive traffic?

-

What is the impact on a railroad if you don’t serve specific markets? Will the railroad also lose this business?

Benchmarking rates into a market leads shippers to explore other alternatives for reducing and evaluating rates. The carrier will always say your rate is a market rate; but the carrier’s interpretation of a market rate will include the highest rate any other shipper pays, not necessarily the average rate and certainly not the lowest rate. As long as there is one other shipper with a higher rate, then your carrier’s interpretation will likely be that you have good rates.

Benchmarking helps you educate railroads on:

-

The rates you need;

-

Why you need them; and,

-

The reasons a railroad should give these rates to you.

It is important to benchmark rates with railroads that have monopoly or duopoly power over your traffic. It is important because this is how you determine what rates are reasonable for your traffic. Without the knowledge obtained from benchmarking you will always tend to get rate increases. Companies benchmark to cut costs and improve performance. Railroads do this and so should shippers!

For more information on rail rate benchmarking between specific origins and destinations click the following link to the blog:

Using Competitor Rates to Reduce Your Rates

The process for determining and negotiating more competitive rates for rail movements is an important part of Escalation Consultants’ Rail Negotiation Seminar. This seminar changes how shippers negotiate rates with railroads. The next Rail Negotiation Seminar is in Tampa, FL on March 19th and 20th. Click image below for more information.

The types of rate benchmarks described in this article are automatically calculated for individual moves or on a macro basis in the Rail Cost Control program (RCC). Click here to learn more about the RCC.