Reduce Captive Rates by Educating Railroads

The March 17th blog titled “6 Ways to Make Railroads Compete for Your Captive Movements” stated that it is important to educate railroads. This is an important way to demonstrate why high captive rates are bad for both you and your railroads. Through this process, you educate railroads on the overall impact of high rates on your business. In addition, this process also shows how you can help improve the railroads business model for your commodities.

The following are five examples of how educating railroads helps reduce rail expenses on captive movements.

1. Capital Investment Plans to Increase or Maintain Production

Your railroad needs to be shown that investment will not be made at locations where you have high costs. The impact of how high captive rail rates impact your capital investment and production volumes is important for railroads to understand. Railroads have lost substantial business in the past by not listening to their customers. Educating railroads on the downside of high captive rates is a beneficial exercise for both you and your railroads.

2. Your Competitors Can Be a Big Source of Leverage in Reducing Captive Rates

There are several reasons for this. One important reason is the location of competitors to your existing and potential customers. When a competitor is close to a customer, this provides a reason for a railroad to provide you with lower rates for movements to that customer. Your competitor will have lower logistics cost, either from a short distance rail move, or by serving the customer by truck. Either way, if you lose this customer, the railroad also loses all or a major part of the revenue it would get from you. It makes economic sense for both the shipper and the railroad to work together to maintain this business.

3. Are You Competing Against Imports?

If the answer is yes, then you and the railroad have the same objective – STOP THE BLEEDING. You both lose out when competing against imports and you will accomplish more by working together than against each other. High captive rates make little economic sense when the objective is to compete more effectively against imports. Reference Blog article “Creating Effective Alliances with Railroads.”

4. Are You a Short Distance from a Port Where Your Product can be Exported?

If yes, then you have additional negotiation leverage. High captive rates can make it more economical to export than ship domestically. When a shipper makes the switch from primarily serving the domestic market to primarily serving the export market, this can have a large impact on a railroad’s revenue and volumes. This can provide effective leverage in captive rate negotiations.

5. Understand Problems with Your Railroad’s Business Model for Your Commodities

Many shippers do not take advantage of information that railroads must provide to the STB. This information is provided due to the monopoly power railroad’s hold over a large amount of their traffic. This information can be valuable to shipper’s rail negotiations. One example is the railroad’s Quarterly Fright Commodity Statistics Reports (QCS). Railroad’s QCS reports show what is good and bad about a railroad’s business model for your commodities. This data provides direction for how you can help improve weaknesses in the railroad’s results for your commodities.

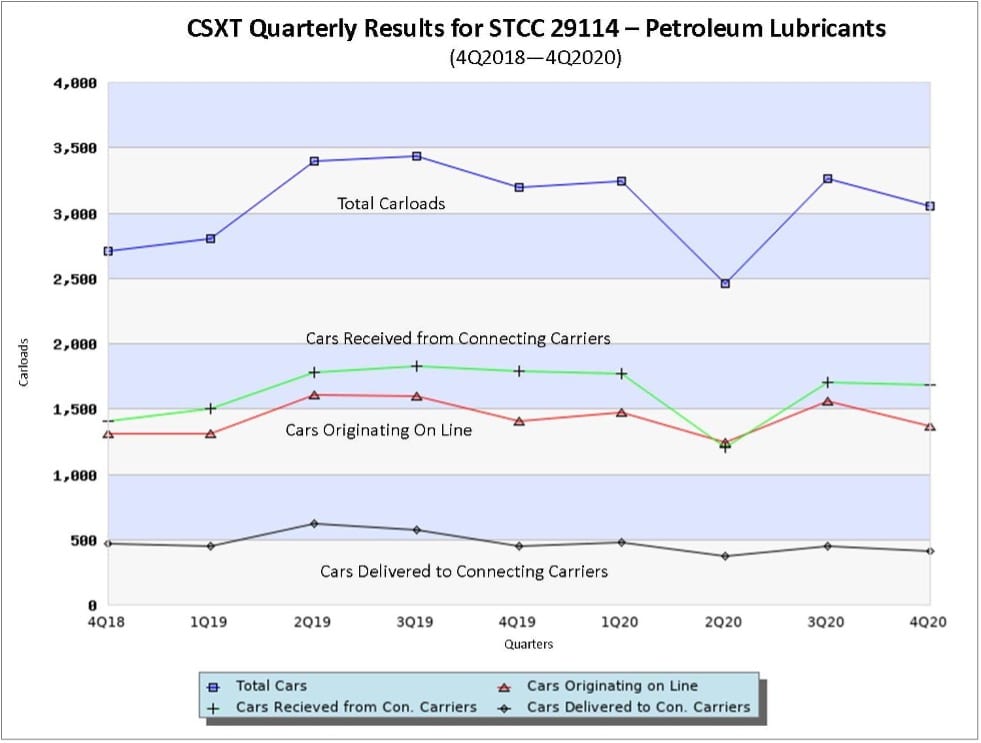

The illustration below provides an example using results for Commodity Code 29114-Petroleum Lubricants on CSXT.

This illustration shows that CSXT receives more cars from connecting carriers than it originates on its lines. This means that there is not enough production capacity on the CSXT system to satisfy the demand for this commodity from customers on the CSXT system. As a result, few cars are delivered by CSXT to connecting carriers.

To grow revenue CSXT needs to provide rates that encourage you to increase production. To incentivize this investment, CSXT needs to, at a minimum, provide lower rates to gateways with other railroads. This would be good for both CSXT and the shipper. CSXT growth is limited without further investment from shippers on its system. High captive rates that stifle growth appear to limit CSXT and its customers revenue for this commodity. This is fertile ground for negotiations focused on reasonable rates for captive movements.

Railroads current and historical QCS results are included in the Rail Rate Checker section of the Rail Cost Control Program. In addition to carloads, the QCS data in Rail Rate Checker includes the following information for each Class 1 Railroad:

-

-

-

-

-

Average rate for moving the commodity

-

Historical change in average rates

-

Total revenue from movements of the commodity

-

How railroads total commodity revenue has changed over time

-

-

-

-

This data is available down to the five-digit commodity code level in the Commodities by Railroad section of Rail Rate Checker.

Rail Cost Control (“RCC”) is a program developed by Escalation Consultants, Inc. to help shippers reduce rail expenses by managing costs and empowering negotiations. Furthermore, for more information about RCC and other related articles, visit the RCC Blog.