Non-Competitive Pricing – The New Norm?

Study shows that shippers need to be more proactive in rate negotiations with their railroads.

The analysis demonstrates that railroads have fundamentally changed how they establish rates for movements. The takeaway from the analysis is that in order to deal effectively with these changes shippers will need to change how they negotiate rates with railroads.

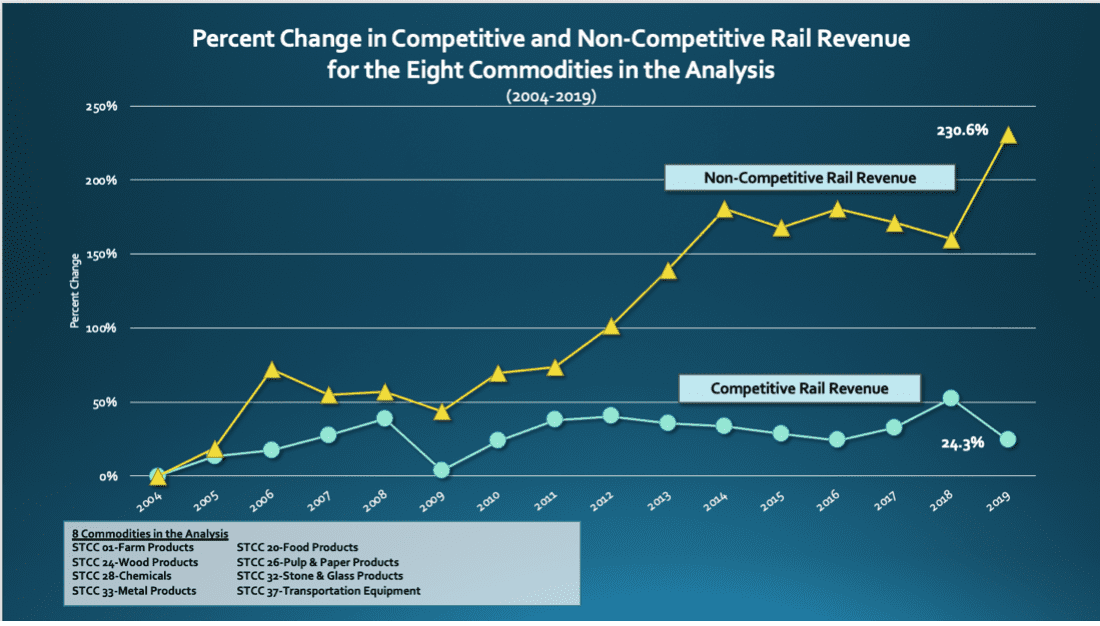

Escalation Consultants analysis of the 8 commodity groups listed below demonstrates a startling finding:

Rail moves with “non-competitive” pricing are no longer the exception. They have become the norm.

The study shows that between 2004 and 2019, railroad revenue generated from competitively priced movements has risen 24.3%. Meanwhile, rail revenue generated from non-competitively priced movements has risen a staggering 230.6%.

To put this into perspective, half (50%) of all rail revenue generated in 2019 was derived from non-competitive rates. Compared to just 27%, in 2004.

Non-competitive rail revenue going from 27% to 50% of rail revenue for commodities represents a dramatic shift in railroad pricing practices. The good news is that this is not a situation without a solution.

Escalation Consultants has found that in order to effectively deal with the changes in railroad pricing practices, you must be more proactive with rail rate negotiations. If not, your rates will likely increase each year, and most traffic will move under non-competitive rates. Being aware that railroad pricing practices have changed is an important first step in building a strong case for lower rail rates. However, shippers must then take corrective actions. To generate cost reductions:

Shippers need an effective plan for both determining and obtaining reasonable rates for their rail traffic.

In 40+ years of assisting rail shippers across ALL industries, Escalation Consultants has helped achieve over $4 billion in cost savings.

If you’d like to learn how, we’re here to help!

Registration for the 2022 Rail Negotiation Seminar is now open. This is the #1 recommended program for rail shippers and slots are limited. Click the link below for more information.