Reducing Rates on Captive Rail Movements – Part 2

Information on Your Railroad that Helps Reduce Rates on Captive Rail Moves

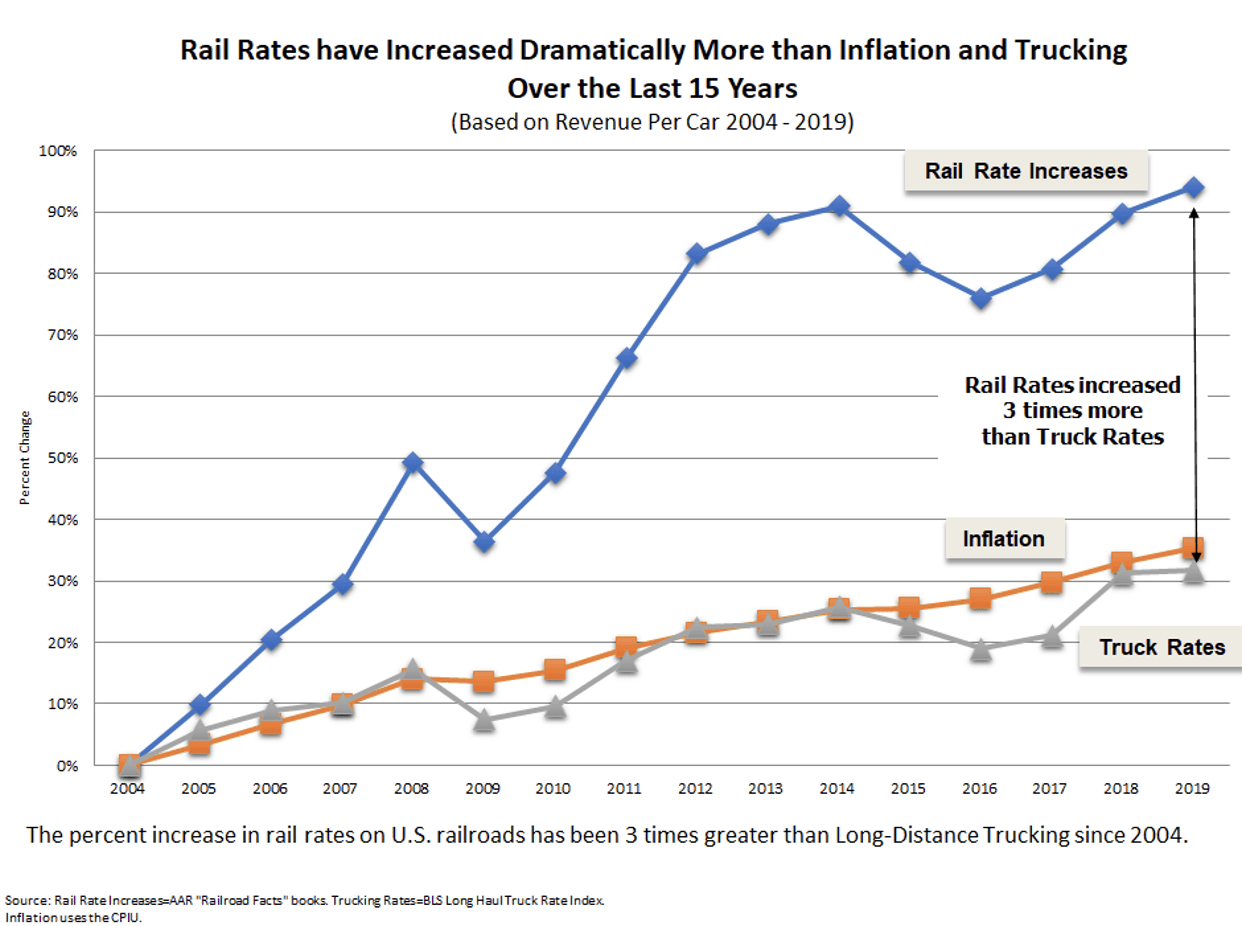

Most shippers agree there are certain things they must know about the railroads with which they do business. Shippers tend to agree they need to know what is happening with costs and rates at their railroads. Even if this type of information does not result in any type of benefit to their rates or services, it is simply required knowledge for a professional in rail transportation. Shippers have found the following railroad data to be very valuable in negotiations.

The Cost of Specific Movements

Shippers need to know the margin railroads make on their movements. This data can be valuable in answering the following types of questions.

- How low could a rate go if a shipper had competitive alternatives?

- What is the profitability of individual movements for a railroad?

- How much combined profit do all of a shipper’s movements provide to individual railroads? (How important are you to a railroad?)

- How much profit will a railroad lose if you take certain movements away and how much profit will it gain if you add movements?

- How will the railroad’s costs change if you change the parameters of your movement?

- And, frequently most important:

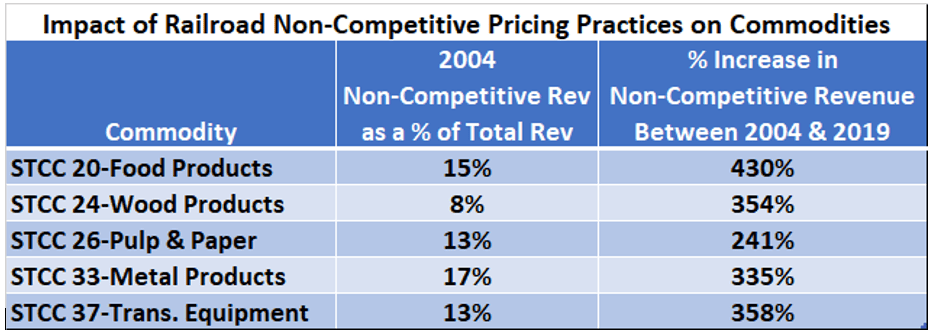

- What the railroads RVC’s for your major movements are in relation to benchmark RVC’s for your commodities.

How Much of a Shipper’s Commodity is Carried by a Railroad

Do you represent 80% of the shipments of a commodity on a railroad, or only 1% of all its shipments? You need to know whether you are the railroad’s only opportunity for carrying a commodity to certain markets. If that is the case, you need to partner with the railroad to penetrate certain areas and that needs to set the tone for negotiations. If a shipper is captive to a railroad but is the only opportunity for that railroad to obtain market share in a region, then it makes no sense for the railroad to give the shipper monopoly level rates. Shippers need to point these opportunities out to their railroads and demonstrate that rate increases are not beneficial to either of their volume and profit objectives.

The Political Impact You Can Have on a Railroad

One of the best and least frequently used methods of increasing negotiation leverage with railroads is political pressure. Railroads frequently interact with state and local officials in areas where shipper’s offices are located. Understanding what a railroad needs from local officials and how your company can help or hurt the railroad’s efforts is a good source of leverage, which frequently goes unused.

On the national level, involvement with congressional representatives in Washington, as well as with the STB can make a shipper much more important to a railroad. The government regulates railroads, and the greater a shipper’s input and access to politicians and regulators, the greater its potential leverage with a railroad.

Escalation Consultants has developed political leverage for many shippers and what we have found is that there is a right way and wrong way to address rail issues with politicians. In addition, all politicians are not equal in the eyes of railroads, but if you do this properly you become more important to a railroad. To give an example, after generating political pressure we had a meeting with the railroad. In the meeting our client was told that it was not the largest shipper of its commodity on the railroads system, but it was now the most important shipper of the commodity. The takeaway from this example is that if you have the ear of someone that is important to a railroad, then you become more important to that railroad.

Click here to read: Reducing Rates on Captive Rail Movements – Part 1