A Regulatory Perspective: Improving Rail Rates on Captive Movements

Improving Rail Rates on Captive Movements

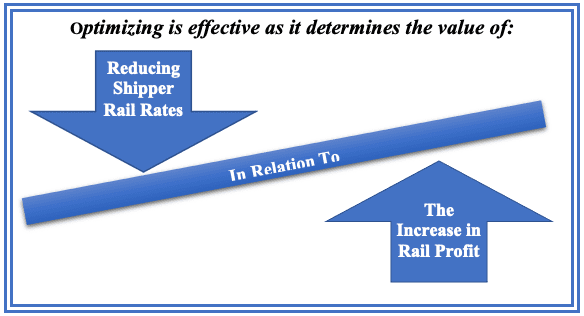

Large increases in railroad’s profitability are improving shipper’s leverage in rate negotiations on captive movements. This is happening because high levels of railroad profit are factored into the RSAM[1] data that the STB uses to determine the outcome of a 3-Benchmark Rate Challenge. Higher railroad profits result in the RSAM data improving the ability for a shipper to win a 3-Benchmark Rate Challenge. This strengthens negotiation leverage on captive movements.

As an example, based upon the latest RSAM data, a rail shipper’s captive rates could be similar to competitor. However, they would be considered more than 25% above competitors’ rates in a 3-Benchmark Rate Challenge. This will be a big deal for many rail shippers.

This blog is not intended to make you an expert on the calculation of the STB RSAM data or on everything that goes into a 3-Benchmark Rate Challenger. The intent of this blog is to provide:

- A general understanding of how the 3-Benchmarks are calculated;

- The impact high railroad profits can have on a shipper’s chance of success in a rate challenge; and,

- The potential change in a shipper’s negotiation leverage on captive rail movements is due to the large increase in railroad profitability.

Calculating the 3-Benchmarks

The following benchmarks are used in a 3-Benchmark Rate Challenge. The STB calculates the values for Benchmarks 1 and 2. Shippers and railroads each calculate the 3rd Benchmark.

Benchmark 1 – RSAM (Revenue Shortfall Allocation Mark-up Ratio)

- RSAM represents the average Revenue to Variable Cost Ratio (RVC) a railroad would need to generate from its rates on all captive traffic (traffic with RVC’s above 180%) to be revenue adequate.

Benchmark 2 – RVC>180%

- RVC>180% represents the average RVC a railroad obtains from the rates for all of its captive traffic (traffic with RVC’s above 180%)

Benchmark 3 – RVC-Comp

- RVC-Comp is the average RVC for movement rates that are comparable to the rate for the contested movement.[2]

Importance of Recent Change in RSAM Values on Shippers Chance of Success in a Rate Challenge

The latest RSAM data substantially improves a shipper’s ability to win a 3-Benchmark Rate Challenge. This is because the recent increases in railroad profitability put significant downward pressure on railroads’ RSAM values and significant upward pressure on its RVC > 180% value. Thus, your rates could be comparable to competitors, but be considered 25% above these rates in a 3-Benchmark Rate Challenge.

To be clear, shippers don’t necessarily need to initiate a 3-Benchmark Rate Challenge at the STB. However, shippers do need to understand that a railroad now has more to lose by not listening to a shipper’s concerns about rates and service on moves where there is a lack of rail competition.

Schedule a quick discovery call to learn how to best navigate these recent increases in railroad profitability & changes in RSAM Values.

[1] RSAM is Revenue Shortfall Allocation Markup Ratio calculated each year by the STB.

[2] Comparable movement rates must have RVC’s above 180%.