The Cost of Being Captive to a Railroad

Traffic that’s captive to one major railroad is priced significantly higher than traffic where railroads must compete for movements. The difference between Captive Traffic and Competitive Traffic rail rates is very large.

Captive Traffic rates are, on average, 107% greater than Competitive Traffic rates.

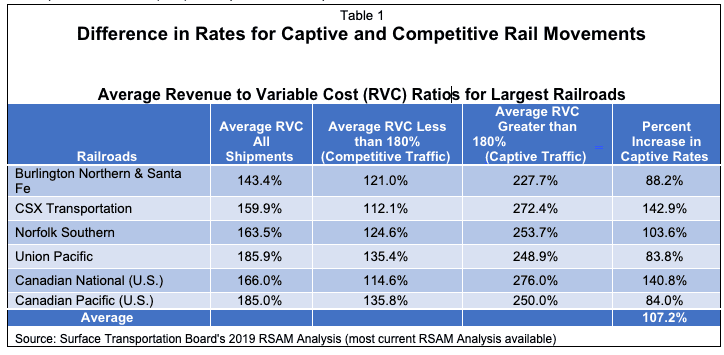

Table 1 demonstrates this rate difference. It illustrates profitability for both captive and competitive movements on the six largest Class I railroads. The table contains the average Revenue to Variable Cost Ratios (RVC) for captive and competitive traffic on each railroad. RVC’s in the table are calculated from the cost and revenue data provided by the Surface Transportation Board (STB) for captive and competitive moves on each railroad.

An RVC measures railroad profitability for movements. It is calculated by dividing the rate for a move by the railroad’s long term Variable Cost (Cost) for the move. Table 1 shows that the 185.9% RVC for Union Pacific (UP) is the highest average RVC. An RVC of 185.9% means that rates are on average 85.9% greater than UP’s Cost for moving its traffic.

The breakdown of UP RVC’s is 248.9% for Captive Traffic and 135.4% for Competitive Traffic. This makes captive rates for UP 83.8% greater than competitive rates ((2.489 – 1.354) ÷ 1.354). The average increase in captive rates on all six railroads is 107.2%.

The largest increases in captive rates over competitive rates are on CSXT 142.9%, CN (US) 140.8% and NS 103.6%.

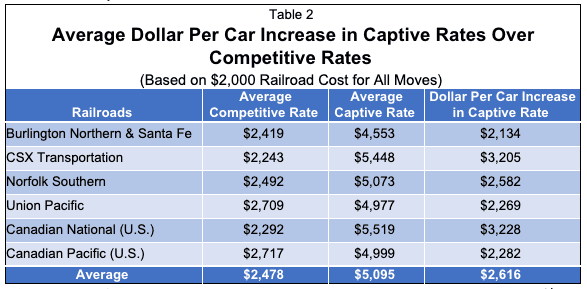

To convert RVC’s in Table 1 to rates, assume that the railroad’s average variable cost of moving captive and competitive carloads is $2,000. Table 2 shows that the average dollar per car increase for all railroads is $2,616.

The average $2,616 captive rate increase, by itself, is greater than the total rate of $2,478 for railroad’s Competitive Traffic.

The most significant captive rate increases, as compared to competitive rates, were observed on CSXT ($3,205) and CN (US) ($3,228). These are by far the largest dollar increase in captive rates.

In order to obtain large rate reductions, shippers must make railroads compete for more of their traffic. There are several ways to accomplish this. With this in mind, Escalation Consultants’ next blog will address: Five Ways to Make Railroads Compete for Your Captive Traffic.

Note – The US railroad industry is regulated by the STB. An RVC of 180% represents the Jurisdictional Threshold for rail movements. This is because the STB has no authority over rates with RVC’s below 180%. Moves with RVC’s above 180% have high levels of profit and are therefore considered captive by the STB. Rail moves with RVC’s below 180% have lower profit levels, and therefore, considered competitive.

Rail Cost Control (“RCC”) is a program developed by Escalation Consultants, Inc. to help shippers reduce rail expenses by managing costs and empowering negotiations. Furthermore, for more information about RCC and other related articles, visit the RCC Blog.