6 Ways to Make Railroads Compete for Your Captive Movements

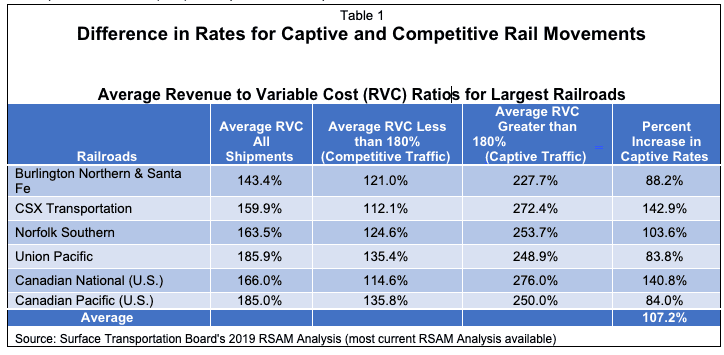

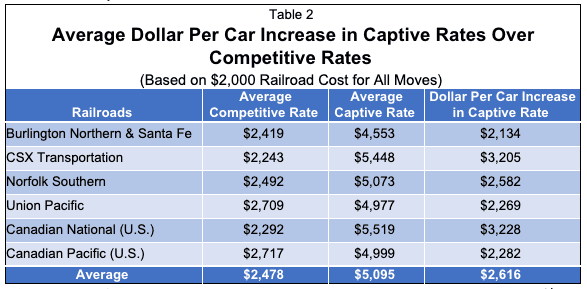

Last week, Escalation Consultants’ blog, “The Cost of Being Captive to a Railroad” showed that traffic railroads view as captive has rates 107% higher than traffic railroads view as competitive. A shipper looking to substantially reduce rates must, therefore, make a railroad compete for more of its traffic. There are a number of ways to do this. The following are six examples to make railroads compete for your captive movements:

1) Alternate Logistic Options:

The cost of trucking and transloading need to be understood. The higher the rail rate for a move the more viable other logistics options become. It is always good to know the ceiling price for rail movements. The cost of alternate logistics determines this price because once rail costs are higher than other logistic options, a railroad can lose the business.

2) Create Geographic Competition:

If you produce a product at more than one plant, you can have railroads provide bid rates from each viable plant to customer destinations. This type of geographic competition can make a railroad compete for movements even though a shipper’s plant only has access to one railroad. Geographic competition can significantly reduce the rates for movements as it makes railroads provide competitive rates at captive locations.

3) Commodity Swap Agreements:

Commodity swaps with competitors are used to reduce logistic cost for both you and your competitors. The framework for a commodity swap:

-

-

-

You have customers closer to your competitors’ plant than your plant,

-

Your competitor has customers closer to your plant than his plant; and,

-

The competitor serves your customer and you serve your competitors’ customer.

-

-

Companies do not like competitors to serve their customers. However, when cost savings are very large a swap agreement is too good to pass up. The higher a railroad’s cost for a movement, the larger the savings from a commodity swap agreement. This type of agreement does not normally last for multiple years. The railroad gets the message loud and clear.

4) Perform an Analysis of the Cost of Building a Rail Spur to Another Railroad:

Many rail spur analyses are performed, but few of these build-outs materialize. The reason, if a rail spur is viable, a railroad is under greater pressure to reduce rates. The railroad will need to lower rates to a level that does not provide the economic incentive for you to build the rail spur. Performing an analysis of the viability of building a rail spur to another railroad can be very valuable in captive rate negotiations.

5) Build a Rail Spur to Another Railroad:

If you build a line to another railroad, then you have two railroads competing for your business. This changes your moves from captive to competitive in the railroads’ pricing model. As demonstrated in the blog, “The Cost of Being Captive to a Railroad”, rates for captive moves are on average 107% higher than rates for competitive moves. Building a rail spur represents significant savings as it generates downward pressure on your rates.

6) Educate Railroads:

A shipper needs to educate railroads on why high rates are bad for both you and your railroads. This means you need to show the overall impact of high rates on your business. The best way to do this is to provide railroad management with information on strategic plans for your company. The information needs to show how railroads can benefit the most and the least from your business, going forward. Railroads have smart people in management. They need to be educated on the benefits of a more competitive rate structure on their business.

The issues presented to railroads will be different for every company. Developing these issues is an important part of preparation for rail negotiations. Examples will be included in the next blog.

These types of issues need to be considered in strategic planning designed to drive down rail expenses for captive movements. Every companies’ situation is different, but things that work best to reduce rail expenses do not change.

To get a better rate structure for your moves, you must make railroads look at your traffic differently!

This is what strategic planning for rail negotiations needs to accomplish. Escalation Consultants works with companies to reduce rates by accomplishing this objective. The Rail Cost Control (RCC) program facilitates this process.

Rail Cost Control (“RCC”) is a program developed by Escalation Consultants, Inc. to help shippers reduce rail expenses by managing costs and empowering negotiations. Furthermore, for more information about RCC and other related articles, visit the RCC Blog.