Generate Maximum Savings Through Optimizing

The blog titled “Optimizing to Reduce Shippers Rail Expenses” showed the process shippers can use to reduce rail expenses by millions of dollars while, at the same time, increasing railroad profit by millions of dollars. This value is created by optimizing railroads rates during a shippers bid evaluation. Win/Win opportunities are created by understanding the relationship between:

The Reduction in Spend a Shipper Receives from Reduced Rates

in Relation to

the Increase in Profit the Railroad can Receive from Obtaining Additional Volumes

The question that needs to be answered is how does a shipper determine the maximum value it can create through the optimizing process? Determining maximum value from optimizing is important as it brings the rate level of captive movements into rail negotiations. To do this a shipper needs to know the Pivot Point for awarding competitive carloads on each railroad.

The Pivot Point represents the point where a railroad makes the maximum profit from reducing a shipper’s rates.

Once the Pivot Point is reached, it becomes less attractive for a railroad to decrease rates to get the award of more competitive carloads. The Pivot Point shows when a rate reduction for the shipper is no longer offset by railroad profit obtained from an increase in carloads.

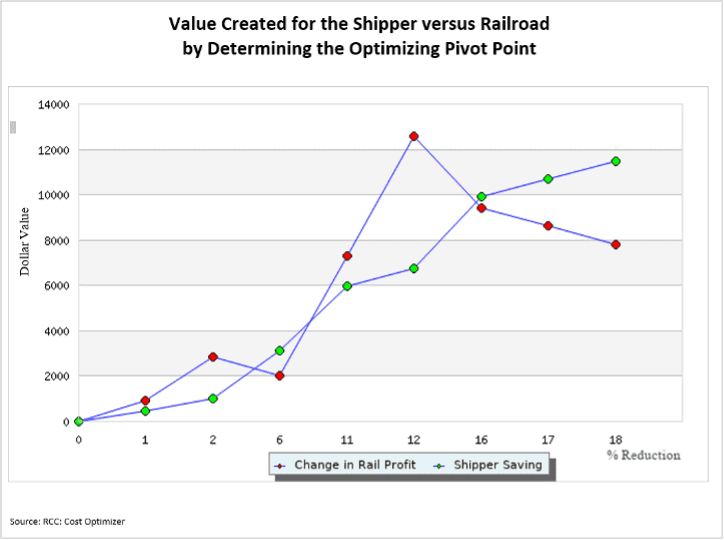

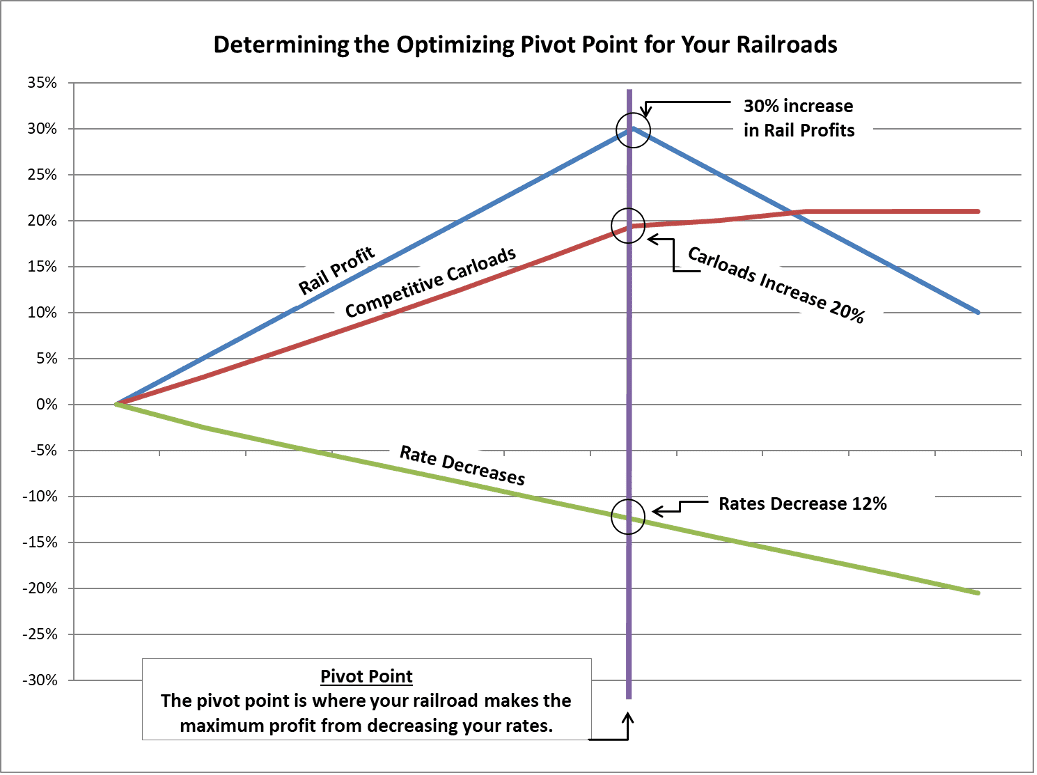

Illustration 1 demonstrates what goes into determining the Pivot Point. Illustration 1 shows that a 12% decrease in bid rates for a railroad’s competitive traffic is the Pivot Point. This decrease results in a 30% increase in the railroad’s profit resulting from a 20% increase in competitive carloads for the railroad. To get the most out of rail negotiations it is important for shippers to know the Pivot Point for rate reductions on each of their railroads.

Calculating the Pivot Point is an iterative process that continues to reduce rates on competitive movements for a railroad. With each rate reduction carloads are then re-award based on the lowest bids for competitive movements to determine the impact on both the railroad and the shipper.

These changes are continually calculated until the Pivot Point is determined. Illustration 2 provides the results of this iterative process for the railroad used in our analysis. This graph shows the dollar savings for the shipper in relation to the change in rail profit for the railroad. These changes result from rate reductions of 1% to 18% in a railroad’s bid rates.

(Note to visually see the impact on rail profit and shipper savings, all dollar values are shown as positive amounts)

A 12% reduction in competitive rates represents the Pivot Point, as this generates the maximum amount of profit the railroad obtains from the award of more carloads. Railroad profit starts decreasing with rate reductions greater than 12%. Shipper’s savings continue to increase with rate reductions but by a 16% reduction the benefit to the shipper is greater than to the railroad. The source for Illustration 2 is the Rail Cost Control Program (RCC).

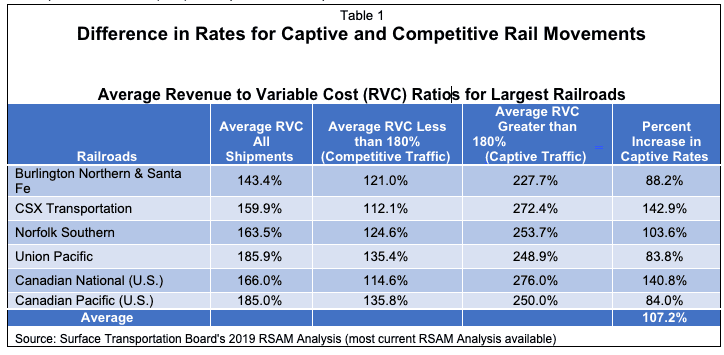

Initially, the Pivot Point normally generates greater value for railroads than shippers.

This is because it represents the maximum increase in profit a railroad can get from reducing its rates. The table below demonstrates this as it summarizes the results for the rail bids used in this article.

Table 1Summary Results for a 12% Rate Reduction on a Railroads Competitive Rates |

|

Shipper Savings |

$6.7 million |

Increase in Railroad Profit |

$12.5 million |

Increase in Railroad Revenue |

$23.0 million |

Increase in Railroad Carloads |

5,100 |

**Table 1 Source: Output Table from the RCC – Cost Optimizer**

Table 1 shows that the railroad makes out much better than the shipper. The railroad makes $12.5 million in additional profit, while the shipper receives savings of $6.7 million. This difference brings rate reductions for captive movements into the optimizing process. Rates for captive movements become part of an iterative process that determines the best split of the benefits between the shipper and railroad through the optimizing process. The source for Table 1 is the Rail Cost Control Program.

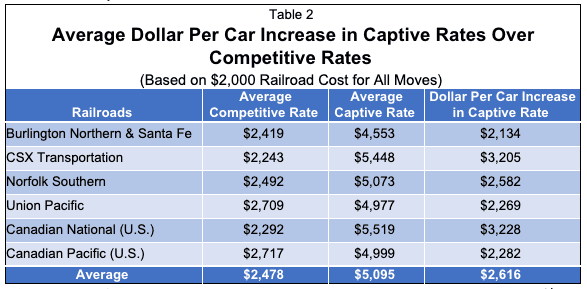

Table 2 provides the results from optimizing after rate reductions for captive rates are included in the optimization process. This table shows the shippers expense is reduced by $9.6 million while the railroads profit is increased by $9.6 million. This is a good deal for the railroad as it makes $9.6 million more in profit and $20 million more in rail revenue than it would receive based on its initial bid rates. This is also a good deal for the shipper as its rail expenses are reduced by $9.6 million.

Table 2Change from Bid Rates Summary Results After Captive Rates are Included in the Optimizing Process |

|

Shipper Competitive Spend Saving |

-$6,814,188 |

Shipper Captive Spend Savings |

-$2,826,917 |

Shipper Total Savings |

-$9,641,105 |

Railroad Competitive Profit |

$12,556,031 |

Railroad Captive Profit |

-$2,904,317 |

Increase in Total Railroad Profit |

$9,651,714 |

Increase in Railroad Spend |

$20,135,460 |

Increase in Railroad Carloads |

$5,100 |

**Table 2 Source – Output Table from the RCC – Cost Optimizer**

When shippers are armed with opportunities created by optimizing rail expenses, they create value for themselves and their railroads. Shippers reduce the rate structure for their movements, while substantially improving profit and carloads for railroads.

The best negotiations are win/win negotiations and optimizing creates this type of negotiation. Therefore, the question is, why haven’t more shippers used optimization to reduce their rail expenses? The answer is complexity and time constraints. This was the reason for the development of the Rail Cost Control (RCC) Program. The algorithms in the RCC’s Cost Optimizer automatically determine the Pivot Point for each railroad and the results to expect from the optimizing process, for both the shipper and railroad. This is a game changer for many companies.

For more information on optimizing rail expenses, check out the Rail Cost Optimizer.

Escalation Consultants, Inc. developed Rail Cost Control (“RCC”) to help shippers reduce rail expenses by managing costs and empowering negotiations. Furthermore, for more information about RCC and other related articles, visit the RCC Blog.