Why Some Rail Shippers Get Lower Rates

Rail shippers that are smarter about their movements get better rates for their traffic.

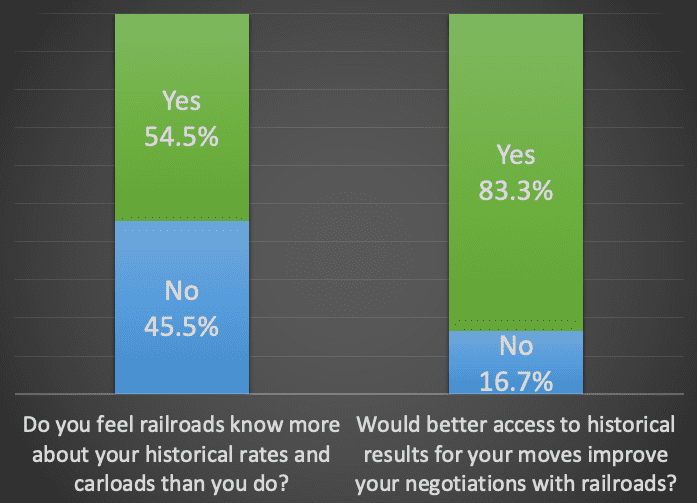

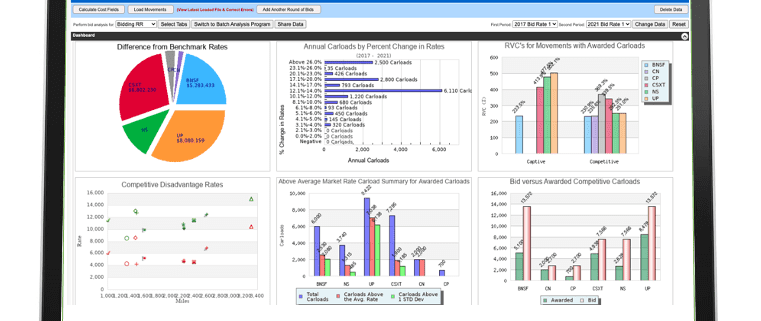

Escalation Consultants, Inc. is in a unique position to see this, as many shippers use our databases to get better rates for their rail movements. The fact is: shippers who know more about their traffic do better in negotiating rates with their railroads.

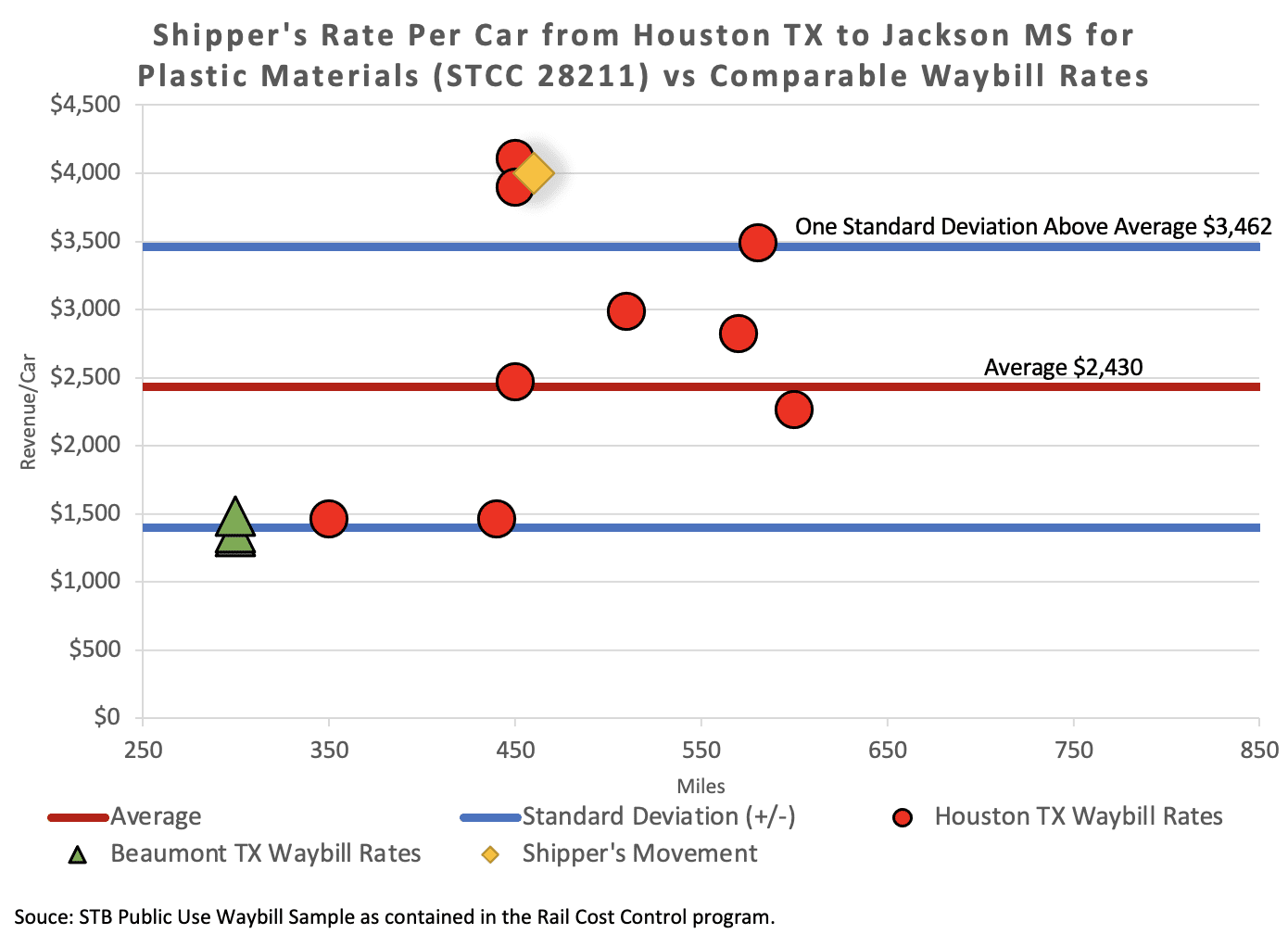

Shippers least cost leverage for obtaining better rates from railroads starts with benchmarking and costing rates for their movements.

The following are examples of how rail shippers have used Escalation Consultants’ market intelligence database to their advantage:

1. A Captive shipper showed the railroad the impact its current rate structure has on reduced volumes into major markets. Market intelligence showed the rates needed to protect this business.

Result – Shipper’s rates were reduced more than 10% to pertinent markets.

2. A railroad proposed a large rate increase on captive movements. The railroad was shown that its rates were already in the upper profitability quartile for moves in certain markets. Additionally, the railroad was shown that its proposed rate increases are higher than the average increase they are receiving from all movements of this commodity.

Result – Railroad pulled back its rate increases, reduced rates on priority movements and signed a multi-year contract.

3. A shipper performed an analysis of the profit structure for a company’s movements on its primary railroad. The analysis showed that the railroad was pricing its movements above competitors on both captive and competitive traffic. A Rate Benchmark Analysis showed the rate structure needed to maintain and increase volumes in problem markets.

Result – Rates were reduced in significant problem markets and the railroad increased the strike price for fuel surcharges without increasing the rates for movements.

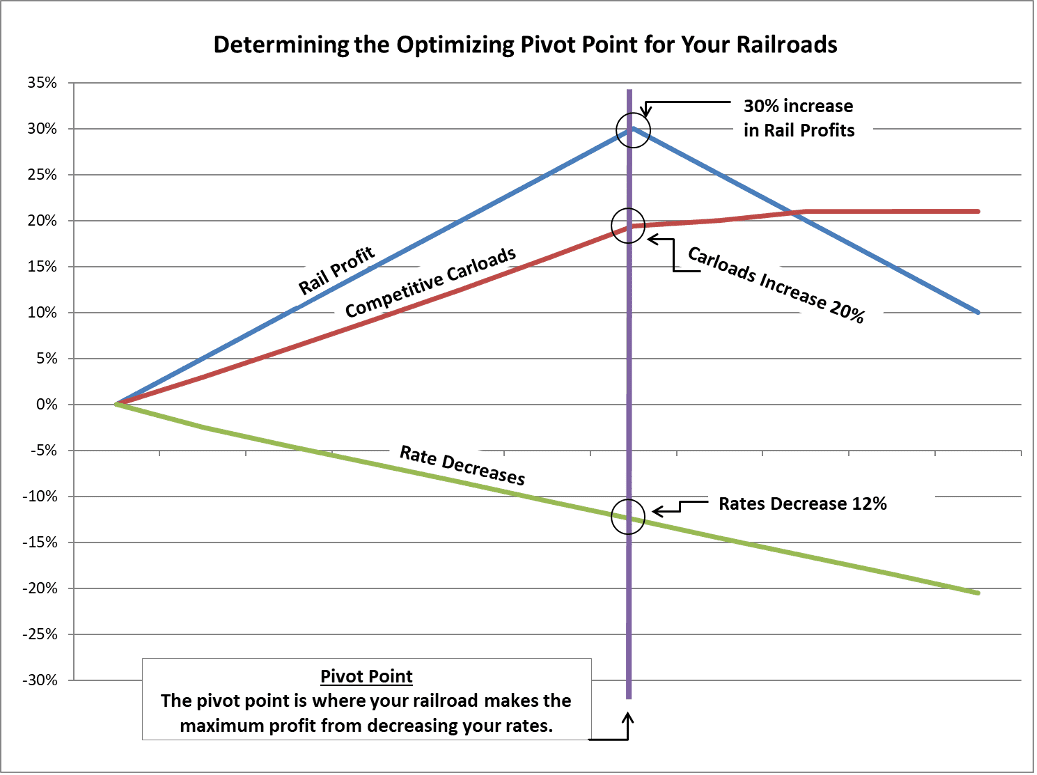

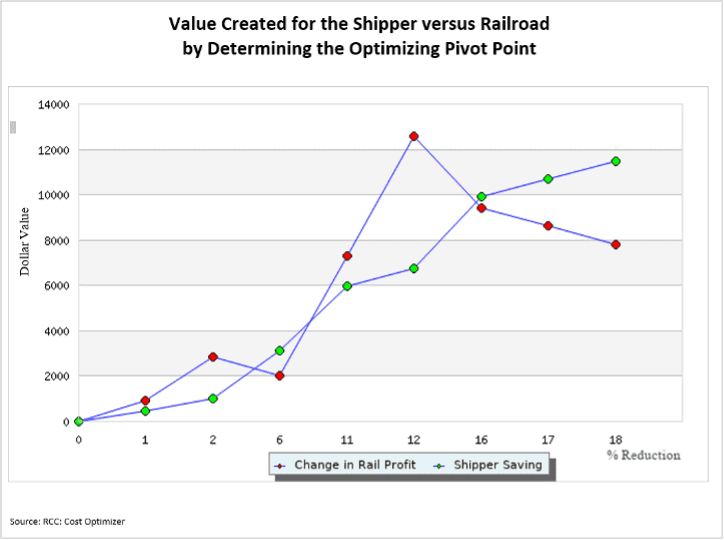

4. The rates and the rail carriers’ profits on all movements from an important market area were analyzed. This determined the market price for the commodity and the impact of increased volumes and lower rates on railroads profit.

Result – Win/win opportunities associated with lower rates were put in place to the benefit of both the shipper and rail carrier.

5. Rail rates for all coal movements originating in the PRB and terminating in a specific state were determined. The range of rates being obtained by plants with and without competitive options was used to support the rates that were and were not reasonable for plants.

Result – Shipper obtained rates in line with its competitor’s plants.

6.The shipper determined competitors’ rates into markets to find out where its rail rates were putting it at a competitive disadvantage in markets.

Result – Rates were reduced in primary markets to keep the shipper competitive.

7. Shipper determined the railroad’s cost and profit for movements and how its rates stacked up to others in major markets.

Result – Rates in several primary markets were reduced to minimize the shipper’s competitive disadvantage in these markets.

The common theme in these examples, is that the shipper was able to gather information on its markets.

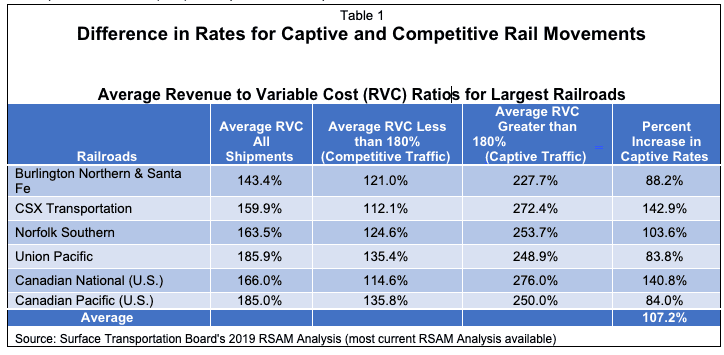

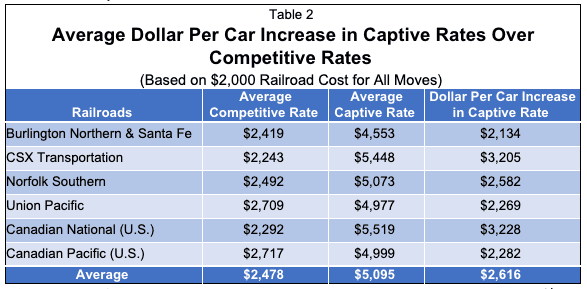

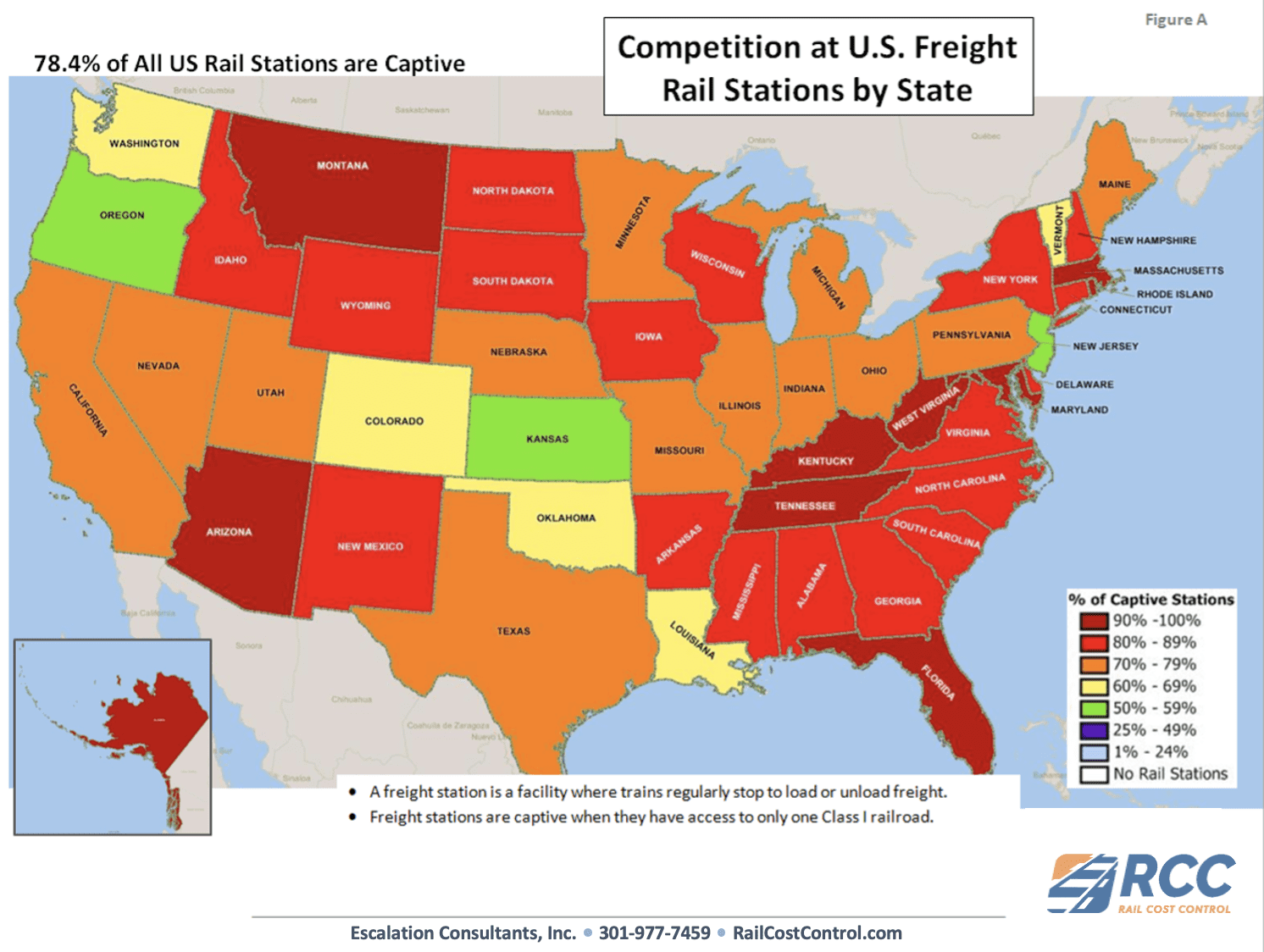

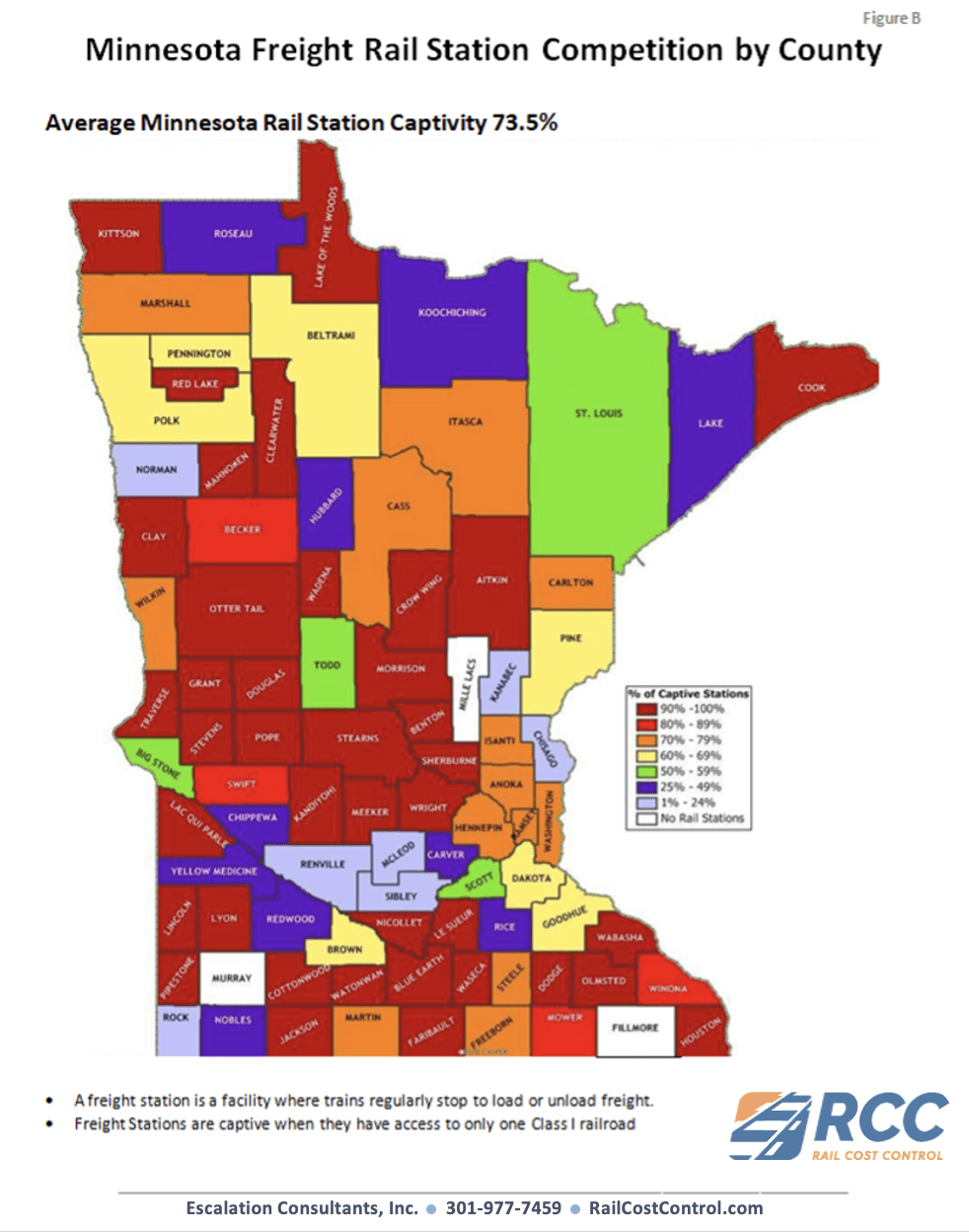

This data allows shippers to clearly demonstrate a problem to the railroad and quantify the rate that provided an equitable solution. The point to be taken is that shippers who are well prepared for negotiations have better negotiations. They also get better rates than shippers that do not completely understand their markets. Rate benchmarking and the costing of rail movements provides ammunition that helps protect rail shippers from excessive rates charged by railroads. These resources are important to help counteract the monopoly or duopoly power railroads have over their customer’s traffic.

When railroads have monopoly power over movements it is up to the shipper to determine if the railroad is abusing this power. Thus, putting the shipper’s business at a competitive disadvantage.

Railroads are sensitive to hurting a companies’ ability to compete in markets. Therefore, benchmarking your rates against competitors is a productive exercise in preparing for rate negotiations. This can be the most productive and least costly option shippers have for obtaining competitive rates for their traffic.

Uncovering, and quantifying rate problems is a major function of effective transportation departments! Many transportation professionals have found that determining reasonable rates for traffic is the first step in obtaining better rates.

Escalation Consultants, Inc. developed the Rail Cost Control (“RCC”) program to help shippers reduce rail expenses by managing costs and empowering negotiations. For more information about RCC and other related articles, visit the RCC Blog.